Evolving markets are prompting drug owners and developers to pursue new business models in the post-blockbuster era.

There is tremendous pressure on the pharmaceutical industry to accelerate the development of novel drugs that meet pressing unmet medical needs, from treatments for widespread chronic illnesses to those for rare diseases. At the same time, there is a clamor for lower drug prices. The U.S. Congress has entered the fray with the 21st Century Cures Act, while FDA has implemented multiple accelerated approval pathways. Sponsor drug companies are increasingly turning to contract service providers for assistance and many are seeking more collaborative relationships — either preferred or strategic partnerships — to ensure success in a highly competitive marketplace.

Real Need For Faster, More Efficient Drug Development

According to a 2014 study by the Tufts Center for the Study of Drug Development (CSDD), it costs more than $2.5 billion and takes 10 years to bring a prescription drug to the market — a 145% increase compared to 2003.1 Numerous factors are contributing to this rise in cost, including the growing complexity of drug molecules, targeted diseases and clinical trials, expanding regulatory requirements and the continued use of batch manufacturing approaches.

As early as 2012, the President’s Council of Advisors on Science and Technology (PCAST) in a Report to the President on Propelling Innovation in Drug Discovery, Development, and Evaluation, not only acknowledged, but urged that new therapies for those with unmet medical needs be doubled within the next 10-15 years. Part of this demand called for the joining of all parties, from industry, academia and the government to work to decrease hurdles such as clinical failure, clinical trial costs, time to market and regulatory uncertainty.2

US Congress Taking Action

After speaking with everyone from medical providers, patients, drug manufacturers and regulators, members of the Energy and Commerce Committee of the U.S. House of Representatives concluded that “Congress must take bold action to accelerate the discovery, development and delivery of promising new treatments and cures for patients.”3 In January 2015, the committee issued the “21st Century Cures Discussion Document,” which was followed in July of that year with the passage of the 21st Century Cures Act (H.R. 6) by the House.4 The nonpartisan legislation aims to streamline the approval process for new drugs, including the addition of $110 million in yearly funding for FDA and nearly $8.75 billion over five years for the National Institute of Health to support basic and translational research. Movement on the Senate version of the bill has been much slower. There were predictions in early April 2016 that the remaining bills would reach the Senate floor, but that did not happen. The main unresolved issue is the dollar amount for mandatory NIH funding.

FDA Already On The Fast Track

The actions proposed in the 21st Century Cures Act to accelerate the drug approval process will extend several programs already in place at FDA that were implemented following passage of the Food and Drug Administration Safety and Innovation Act (FDASIA) in 2012. Currently, FDA has four programs that are designed to speed the approval of drugs that meet certain criteria — Fast Track and Breakthrough Therapy Designations and Accelerated Approval and Priority Review processes — while maintaining the safety and effectiveness of these treatments.5

Fast track status is awarded to drugs that treat serious or life-threatening conditions and also fill an unmet medical need, while breakthrough therapies provide substantial improvement over available drugs on the market. Priority review status is granted to drugs that have both improved safety and effectiveness compared to existing therapies and are evaluated by FDA within a shorter period of time (generally six months).

Many companies are also developing small-volume drugs that are designed to treat rare diseases, particularly those with the potential to treat multiple indications.

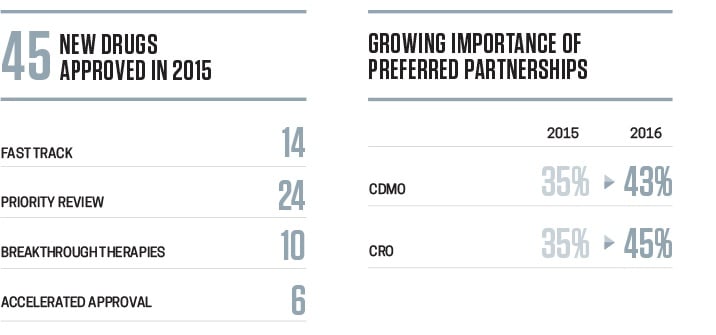

In 2015, FDA accepted 45 novel drugs, new molecular entities (NMEs) under New Drug Applications (NDAs) as well as new therapeutic biologics under Biologics License Applications (BLAs), slightly up from the 41 approved in 2015 and a much higher number than the average of 28 approved annually over the past decade. Of the 45 new drugs approved in 2015, 14 (31%) were designated as Fast Track, 10 (22%) as Breakthrough Therapies, 24 (53%) for Priority Review and 6 (13%) for Accelerated Approval.5 Of the 41 drugs approved in 2014, 17 (41%) were designated as Fast Track, 9 (22%) as Breakthrough Therapies, 25 (61%) for Priority Review and 8 (20%) for Accelerated Approval.6 Overall, 27 (60%) of the 45 novel drugs approved in 2015 and 27 (66%) of the 41 new drugs approved in 2014 fell into one or more of the expedited categories.5,6

The FDA NDA 505b2 pathway also provides a way to facilitate the approval of new indications for existing APIs through references to existing safety data and studies, which decreases overall development times.

Many companies are also developing small-volume drugs that are designed to treat rare diseases, particularly those with the potential to treat multiple indications. According to market research firm EvaluatePharma, phase III development costs for orphan drugs are typically half those for non-orphan drugs.7 In 2014 and 2015, approximately 41% and 47% of the novel new drugs approved each year were destined to treat rare or orphan diseases.

Role Of Contract Service Providers

As drug molecules and manufacturing processes have increased in complexity and pressures to reduce costs and achieve greater productivity and efficiency have intensified, pharmaceutical companies have turned with growing frequency to contract research and contract development and manufacturing organizations (CROs and CDMOs, respectively) with specialized expertise and the ability to facilitate the acceleration of drug development and commercialization efforts. In fact, global bio/pharma companies outsource approximately one-third of their drug product manufacturing activities. Contract manufacturing organizations account for approximately 33% of the bio/pharmaceutical industry’s cost of goods for drug products, according to PharmSource.8

Market research firm Roots Analysis confirms the CDMO evolution across the entire pharmaceutical industry, with contract service organizations offering services from design and discovery to final packaging.9 Such integrated services eliminate tech transfer issues and thus can reduce costs, complexity and time to market.10

One consequence has been the move from a typical vendor-customer relationship to strategic partnerships between contract service providers and their customers, largely with the goals of reducing costs, increasing efficiencies, expanding product pipelines and boosting market competitiveness. Another has been a reduction in the number of contract organizations dominating the market; just 30 CMOs account for more than 50% of outsourcing revenues.8 These larger companies are better positioned to form the preferred and strategic partnerships that pharmaceutical manufacturers are looking for.

Strategic partnerships are not just about capacity, but investing in quality and leveraging expertise, knowledge and brainpower, which require closer relationships, more trust and long-term commitments.

Collaboration Is Key

Accelerated drug development projects often require the use of effective cross-functional teams and careful project planning for development and scale-up activities. The generation of safety and efficacy data, and the development and validation of manufacturing routes and analytical methods, must be accomplished in much less time (often half or less) than is allotted for non-accelerated programs. Communication within the pharmaceutical company and the CRO/CDMO, between the sponsor firm and its contract service providers, and between the sponsor/service organizations and relevant regulatory agencies is also crucial.

Interactions with FDA and management of rapid process scale-up and optimization activities, which are often conducted in parallel with production of clinical trial quantities, requires close collaboration between the CDMO and the innovator company. Ideally, the contract service provider acts as an extension of its customer rather than only as a vendor.

“Smartsourcing,” or the formation of strategic relationships with outsourcing partners, involves a more flexible, “value by innovating” philosophy, according to Biostorage.11 Strategic partnerships are not just about capacity, but investing in quality and leveraging expertise, knowledge and brainpower, which require closer relationships, more trust and long-term commitments.12 Strategic partnerships with CROs/CDMOs also typically involve more specialized arrangements, such as multiphase integrated development, dedicated capacity agreements and asset transfers.13 CROs and CDMOs are also forming more in-depth partnerships with other contract service providers with complementary capabilities to be able to provide their customers with a comprehensive network of services.13

Tactical Players Should Reconsider

The growing importance of preferred and strategic partnerships is clearly revealed in the 2016 Nice Insight CDMO and 2016 Nice Insight CRO Outsourcing Surveys. The demand for a preferred partnership rose from 35% in 2015 to 43% and 45% among CDMOs and CROs, respectively, in 2016. Big pharma is especially interested in forming strategic partnerships, with 36% of pharma companies seeking this type of arrangement when selecting a CDMO.14,15,16 For the surveys, strategic partnerships are defined as “long-term, win-win commitments between two organizations for the purpose of achieving specific business objectives by maximizing the effectiveness of each participant’s resource.”

Tactical suppliers should not lose hope, however. There is a good chance that they can become preferred providers: respectively 81% and 75% of respondents to the 2016 Nice Insight CDMO and Nice Insight CRO Outsourcing Surveys indicated such a transformation is likely or very likely. Preferred providers have a slightly stronger chance of becoming strategic partners (83% and 77% for CDMOs and CROs, respectively).

References

- PR Tufts CSDD 2014 Cost Study. Rep. Tufts Center for the Study of Drug Development. 18 Nov. 2014. Web.

- “President’s Council of Advisors on Science and Technology (PCAST).” Report To The President On Propelling Innovation In Drug Discovery, Development, and Evaluation. Sept. 2012.Web.

- “21st Century Cures Discussion Document.” The Energy & Commerce Committee. 27 Jan. 2015. Web.

- “H.R.6 –114th Congress (2015-2016): 21st Century Cures Act.” Congress.gov. 114th Congress. Web.

- “Fast Track, Breakthrough Therapy, Accelerated Approval, Priority Review.” U.S. Food and Drug Administration. 14 Sept. 2014. Web.

- “Novel New Drugs 2014 Summary.” Novel New Drugs 2014 Summary (2015): U.S. Food and Drug Administration. Web.

- New Report Shows Orphan Drug Market to Reach $176 Billion by 2020. EvaluatePharma. 24 Oct 2014. Web.

- Miller, Jim. “What’s Next for the CMO Industry?” PharmSource. Web.

- Biopharmaceutical Contract Manufacturing Market, 2015 - 2025. Rep. Roots Analysis. 5 May 2015. Web.

- Shanley, Agnes. “The Future of Contract Services.” Pharmaceutical Technology. 1 Feb. 2015. Web.

- “Collaborative Partnerships That Optimize & Accelerate Pharmaceutical Drug Development.” BioStorage Technologies. Web.

- “Strategic Partnerships Accelerate Drug Development and Maintain Momentum in Massachusetts.” MassBio. 2015. Web.

- Arnum, Patricia Van. “Outsourcing Clinical Trial Development and Materials.” Pharmaceutical Technology. 2 June 2010. Web.

- Nice Insight’s Annual Pharmaceutical and Biotechnology Outsourcing Survey 2015.

- The 2016 Nice Insight Contract Development & Manufacturing Survey.

- The 2016 Nice Insight Contract Research – Preclinical and Clinical Survey.